social-security-card-online-ssn Things To Know Before You Buy

social-security-card-online-ssn Things To Know Before You Buy

Blog Article

Once you have your EIN Number, you may continue to open a non-US resident LLC checking account and keep on on with your business.

Hey Levente! No concerns ;) Even though I haven’t employed that correct iPhone fax application, if it might send out and acquire faxes, it ought to operate high-quality. Feel free to post an update to substantiate Once you get your EIN!

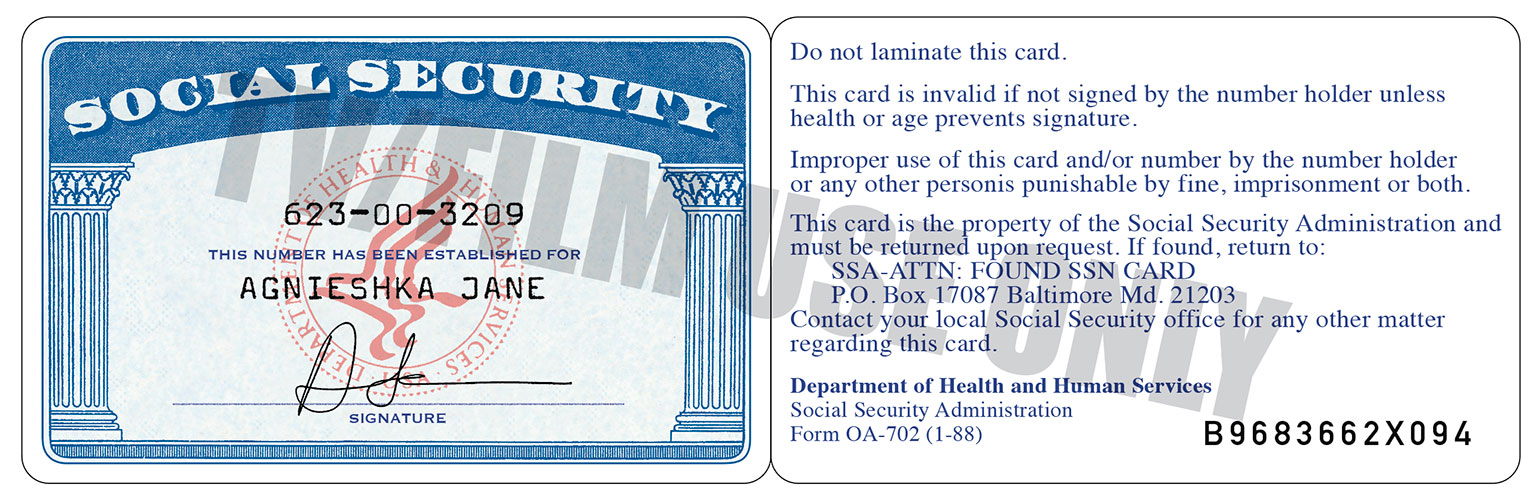

In constrained instances, you may be able to do that entirely online, but typically, you’ll have to visit a Social Security Place of work.

She suggested to contact this 7 days. But the opposite male from IRS 2 weeks in the past told me to resend the shape SS4.

You will need to carry proof from the name transform and proof of your respective identification. Proof on the title transform can be:

Hi Rocky, maybe wait around An additional week or two and simply call again. Then whenever they nevertheless can’t discover your software, then file an SS-4 all over again. The one factors I say hold out a bit for a longer time is always that we’ve by no means heard about the IRS shedding an application.

You will pay U.S. taxes depending on what nation you're from, what tax treaty is in position, how and the place your LLC tends to make money, wherever your clients are, If the LLC provides a “long-lasting institution” from the U.

And uncover whether or not the program’s provider community covers the Physicians and hospitals you should use. Watch out for flex card frauds if another person statements to be from Medicare giving one of those cards. It may be an ID thief endeavoring to steal your personal information and facts.

three- is there an opportunity I could get a replica or find my SSN from your authorities, while not having to check out United states of america?

While using the IRS, you can just use your own home address as part of your region. The address doesn’t should be the address full documents website with the LLC. Towards the IRS, it’s simply just a “mailing deal with” that can be Situated anywhere on this planet. Hope that helps.

You have forty learn more about new social-security-card-online-ssn five times from any time you filed the online portion of the appliance to seem in human being with proof of identification plus the name improve. In order to avoid lengthy waits at your local Business, Social Security suggests contacting upfront to schedule an appointment.

five months to acquire an EIN should you file by mail. Following sixty two times, here information about social-security-card-online-ssn you may connect with the IRS and ask for an EIN Verification Letter (147C). There isn't any other method of getting an EIN for non-US residents, so please Wait and see.

I unintentionally despatched a corrupted ss4 type, after which you can I despatched again the proper ss4 form to the IRS fax.

As well as In case you have an ITIN, numerous foreigners get an mistake information (an IRS reference number) at the end of the online EIN software and end up being forced to use Type SS-4.